Call Us: (800) 762-0436

A Key Member Advantage

As a member of Wheatland Electric Cooperative Inc., you are also an owner of the co-op. Because we operate on a not-for-profit basis, one of the most valuable and unique benefits of your membership is capital credits.

What Are Capital Credits?

Capital Credits represent your share of the cooperative's margins (revenue remaining after all operating expenses are paid) during the year you received service. They are not profits in the traditional sense, but rather a form of member-provided equity.

The process of handling capital credits occurs in two steps:

Allocation

- Each year, if the cooperative's revenue exceeds its expenses, the remaining funds (the margins) are calculated.

- Your share of these margins is formally assigned or "allocated" to your capital credit account based on how much electricity you purchased that year.

- Wheatland Electric meticulously tracks this allocated amount for every member.

Retirement (Payout)

- The allocated capital credits are retained by the cooperative for a period, typically up to 25 years. This money forms the co-op's equity—the largest source of funding used for essential purposes like:

- Maintaining and upgrading the electric system (poles, wires, equipment).

- Meeting financial obligations.

- Reducing the amount of money the co-op must borrow, which helps keep electricity rates more affordable.

- The decision to return or "retire" the capital credits is made annually by the WECI Board of Trustees. If the co-op’s financial health is favorable and stable, trustees approve the payout of credits allocated for a specific past year or years.

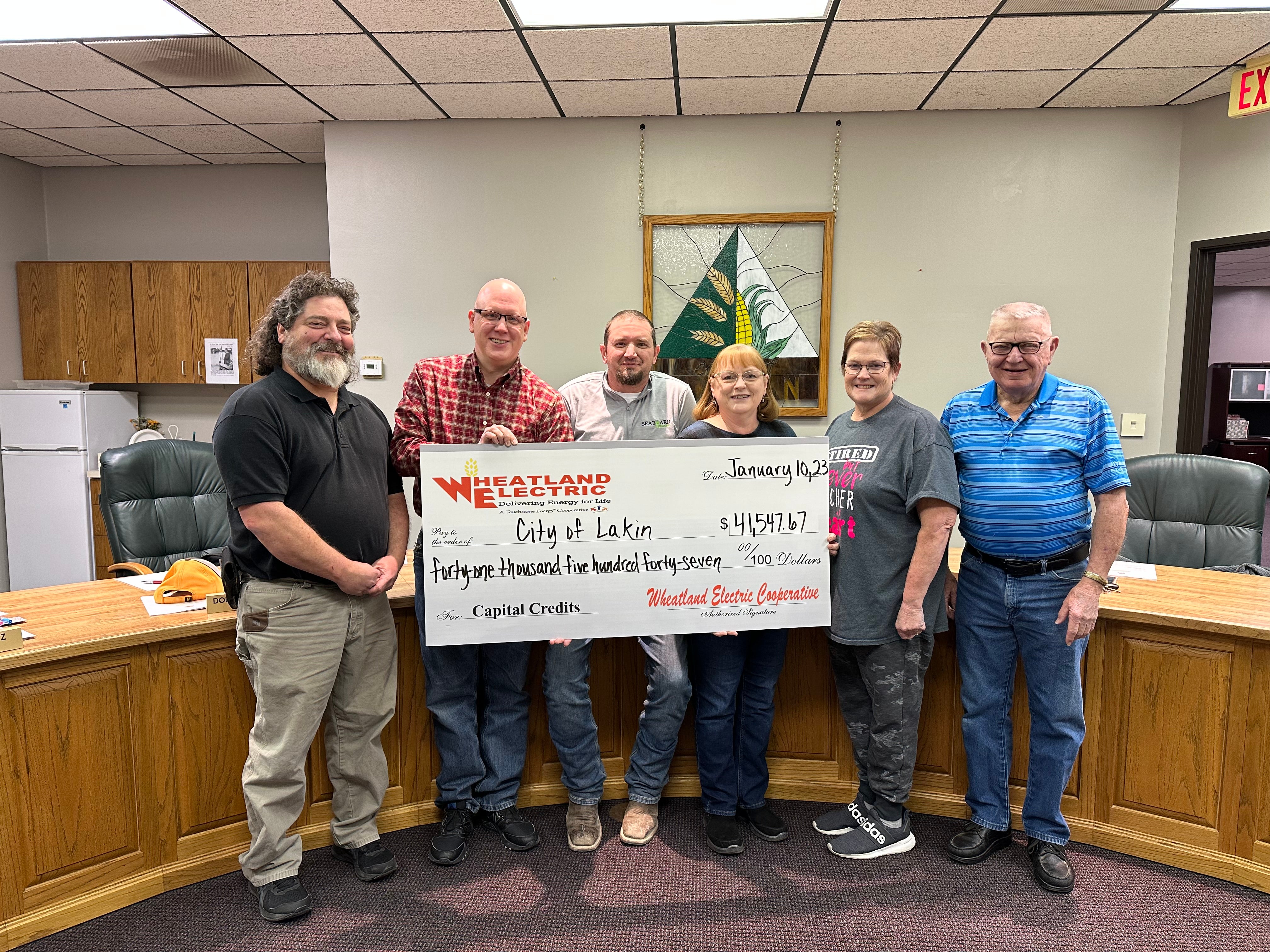

- When credits are retired, members who received service during those designated years receive their share, usually as a check (amounts totaling $25 or more) or a credit on their electric bill.

- The allocated capital credits are retained by the cooperative for a period, typically up to 25 years. This money forms the co-op's equity—the largest source of funding used for essential purposes like:

A helpful way to remember the difference is that allocations are saved, whereas retirements are paid!

Image